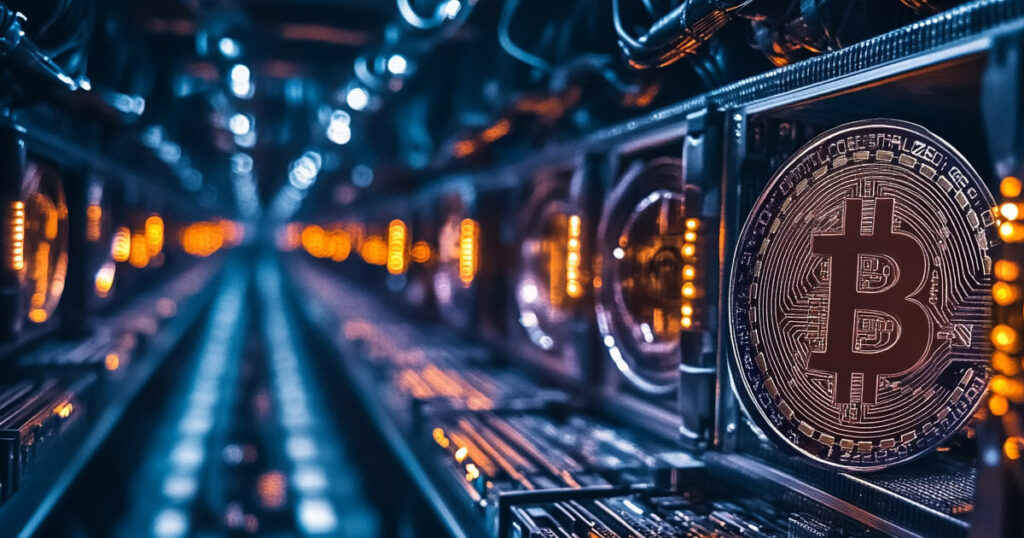

SEC confirms PoW crypto mining exempt from securities law

The US Securities and Exchange Commission (SEC) has clarified its stance on crypto mining under proof-of-work (PoW) protocols, stating that mining activities do not involve offering and selling securities. This applies to assets such as Bitcoin (BTC) and Litecoin (LTC).

In a March 20 statement, the SEC’s Division of Corporation Finance stated that participants engaged in PoW mining do not need to register transactions with the Commission under the Securities Act of 1933 or qualify for an exemption from registration.

Understanding on mining

The SEC’s statement focuses on “Protocol Mining,” which encompasses activities related to validating transactions and maintaining network security on PoW-based blockchains.

These blockchains operate without a central intermediary, relying on miners contributing computational resources to verify transactions and secure the network. In return, miners receive rewards in the form of newly minted crypto, which the statement refers to as “Covered Crypto Assets.”

The SEC distinguishes mining from activities that might constitute securities offerings under federal law. The regulator sees mining as solving complex cryptographic puzzles to add new blocks to the blockchain, a process that does not require miners to own the network’s native crypto asset.

Under the Howey Test, which determines whether an asset falls under securities regulations, miners’ computational effort is considered an administrative or ministerial activity rather than an investment contract.

Administrative role

The statement also addresses the role of mining pools, where individual miners combine computational resources to improve their chances of successfully validating new blocks.

The SEC maintains that miners participating in pools are not engaging in securities transactions, as their earnings derive from their computational contributions rather than the managerial efforts of a third party.

Pool operators, who coordinate mining activities and distribute rewards, primarily engage in administrative functions rather than entrepreneurial or managerial efforts that would classify mining pools as securities offerings.

The SEC’s clarification provides regulatory certainty for PoW miners and mining pool participants, reinforcing that their activities do not fall within the scope of federal securities laws.

By confirming that mining activities remain outside the definition of securities transactions, the statement ensures that miners can continue their operations without additional compliance burdens related to securities regulations.

Mentioned in this article